INCREASING THE FLOW OF CAPITAL FOR GOOD - INVESTING AND GIVING

In a world of growing social issues and falling public spending, the need for social investment has never been greater. In this article, we explore the different approaches that can be taken, the UK retail market context and the role advisers can play – now and in the future.

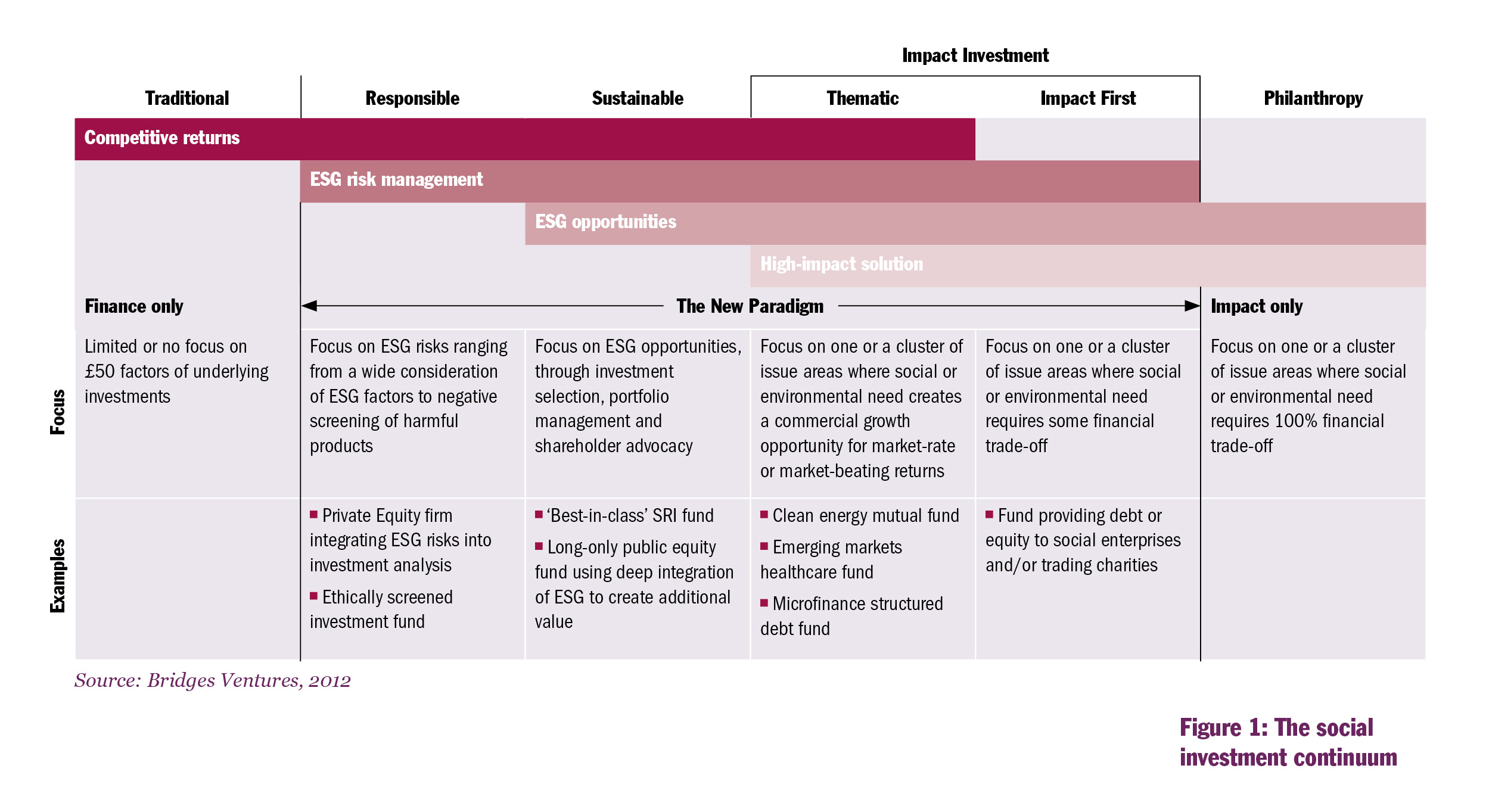

Social investing is at the core of a broad investment spectrum that runs from philanthropy to responsible and sustainable investment. It is designed to provide finance to generate social and financial returns to address some of society’s most important issues supporting the mission of the ‘Sustainable Development Goals’1.

Social investing can bring benefits to enterprises, charities and investors alike. For enterprises and charities, it can help finance innovation and growth, improve commercial skills and strengthen governance and accountability; for investors, it provides another route to reflect personal values, reputational or political risks in their portfolios and to engage with environmental or social change 2.

The UK context for social investing

According to Big Society Capital, the value of social investment in the UK was around £1.5m at the end of 2015. Over two-thirds (70%) of this investment is channelled to charities and social enterprises. And social investment activity is growing: in 2015, £427m of investments were committed – up from £165m in 2011 3.

Social investing has also featured high on the UK’s public policy agenda for a couple of years. In 2011, the UK Government set out its ambition for a bigger social investment market4 focusing on three clear areas:

1. Increasing the supply of social investment

2. Increasing the demand for social investment

3. Creating an environment that allows the market to thrive.

This commitment towards social and impact investing has led to multiple initiatives in the UK so far:

• The creation of the world’s first independent wholesale social investment institution –Big Society Capital – which had committed over half a billion of investment with its partners to the social sector by the end of 2015.

• The development of the world’s first ‘Social Investment Tax Relief’ which is set to unlock £480m worth of investment over the next five years.

• The launch of the US$100m ‘Dementia Discovery Fund’ and the £7m ‘Arts Impact Fund’ – two structured funds that combine public and private money to create positive social impact.

• The development of the ‘Investment Readiness Programme’ which aims to stimulate further demand for social investment through the world’s first ‘Investment and Contract Readiness Fund’ (ICRF), ‘Social Incubator Fund’ and ‘Impact Readiness Fund’.

• The creation of Access, a new £100m charitable foundation, in partnership with the Big Lottery Fund and Big Society Capital which acts as a champion for charities and social enterprises at the early stages of development, providing finance and support for growth.

• The launch of the ‘Centre for Social Impact Bonds’ (SIB) to support new SIB development, alongside a ‘Social Outcomes Fund’ to assist local commissioners to develop new SIB propositions. These SIBs are addressing a range of social issues, from youth unemployment and children in care to longterm health conditions and social isolation.

• Last, but not least, social investment was incorporated into the UK Government’s international ‘GREAT Britain’ campaign, to promote the UK as the global hub for social economy and increase social investment into the UK market.

As part of the UK’s social and impact investment programme, the UK also placed social investment on the G8 agenda in 2013 – through a dedicated ‘G8 Social Impact Investment Taskforce’5.

What role can independent financial advisers play?

While social investment approaches have led to multiple government-backed initiatives and have become common practice among institutional investors – with total AUMs in sustainable investing reaching US$21.4 trillion in 2014, globally6 – the retail market in the UK (and elsewhere) initially struggled to adopt the concept more widely.

Generally speaking, assets under management were holding up, as was relative performance. Research, information and education services for advisers, e.g. as developed by SRI Services7 and Worthstone8, were available – yet, clients were typically expected to request socially responsible (SRI) or ethical investments if they wanted advice on this market. This was partially due to the fact that independent financial advisers (IFA) in the UK were cautious and uncertain about advising clients on social and impact investing.

The situation started to change in 2012, when Nesta and the advisers firm Worthstone issued a joint-report on Financial Planners as Catalysts for Social Investment9. Their report demanded that social (impact) investing had to be brought into the mainstream. It stated that IFAs were overwhelmingly convinced there was client demand for the asset class but were unsure how to advise on it. It also concluded that IFAs had a pivotal role to play in encouraging social investment, but needed better guidance and more clarity from the FSA on how to use it in client portfolios.

In response, the FSA kickstarted an educational initiative for IFAs on social impact investing in 2013, outlining that sustainable and social investments were essential for the future of the UK’s infrastructure and for ‘dealing with environmental and human wellbeing’10.

A dedicated research report entitled Marketing Social Investments - An Outline of the UK Financial Promotion

Regime from the Social Investment Research Council11, commissioned by the City of London Corporation, finally followed in 2014.

It found that regulatory rules around investment suitability in the context of the Financial Promotion Regime were deterring advisers from recommending social investments, which had an impact on growth in the sector. The report also revealed that the majority of advisers still regarded social investments as riskier than mainstream commercial products and concluded that financial advisers were ultimately acting as a barrier between social investment opportunities and clients.

Following this analysis, and the new focus on the role advisers need to play, the tide is finally turning. In March 2016, Rob Wilson MP, Minister for Civil Society announced the UK Government would support advisers seeking to enter the social investment market as part of its ‘vision of a bigger, stronger society here in the UK’12.

The next steps now need to be taken jointly by advisers, who will need to ensure that social investment is right for their clients, and by retail investors, who will need to ask themselves whether positive social impact is an investment objective, alongside financial return. Social investment is still in its infancy but it is likely to be a growth area over the next decade with financial planning positioned to play an important role.

Social investment outlook

New opportunities in social investing are emerging – for investors, policy makers, IFAs and service providers. Here are a few key developments:

• More demand for social investment – there is both an appetite for social investment among retail investors, and a sufficient number of retail investors to be of interest to social enterprises seeking investment capital.

• Education and capacity building – accredited education, training and assessment are key strategies for bringing social investment to the mainstream. In this context, Worthstone will launch FCA-accredited social investment training this year to ensure the competency of those advisers interested in social investment.

• Data consistency and transparency – there is a clear need for more data consistency and transparency. Advances in technology and open/big data are helping to push social metrics forwards, and fund ratings, as provided by orningstar13, will enable investors and advisers to evaluate how well the companies held in their funds are managing their environmental, social and corporate governance (ESG) risks and opportunities.

• Multi-stakeholder efforts and cooperation – there is a strong momentum building for social investment across all stakeholder groups. Increased cooperation will enable the market to expand more rapidly and to overcome areas of uncertainty. And as government funding for social initiatives is redefined due to the tightening of public spending, there is an opportunity for private investors to step into the breach.

This article first appeared in Issue 12 of Philanthropy Impact Magazine. Download this article as pdf.